Is Boeing Stock Outperforming the Dow?

/Boeing%20Co_%20corporate%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $179.5 billion, The Boeing Company (BA) is one of the world’s largest aerospace and defense contractors. It designs, manufactures, and services commercial jetliners, military aircraft, satellites, missile defense systems, and space exploration technologies for customers worldwide.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks, and Boeing fits this criterion perfectly. The company operates through three main segments: Commercial Airplanes, Defense, Space & Security, and Global Services.

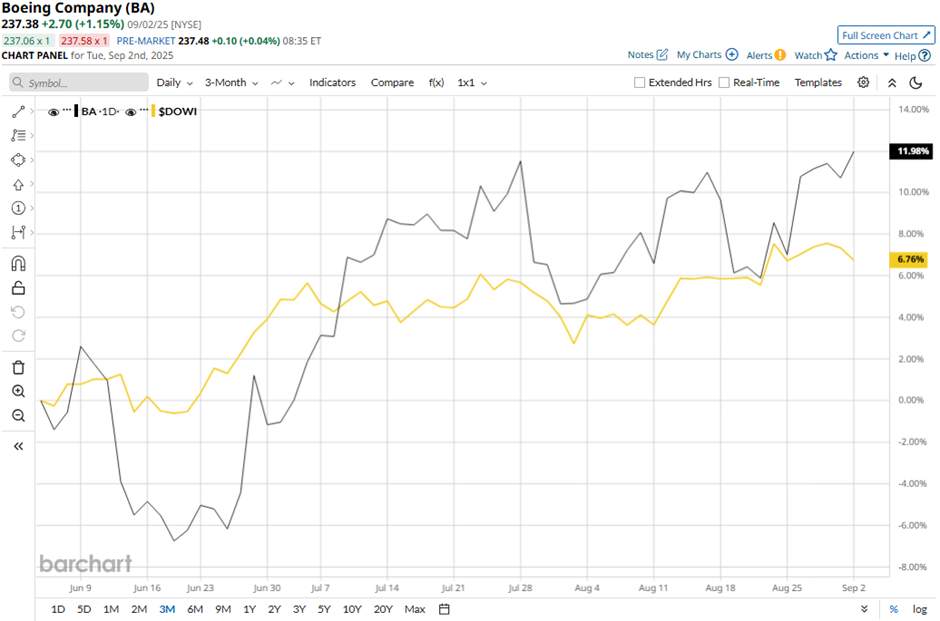

Shares of the Arlington, Virginia-based company have declined 2.2% from its 52-week high of $242.69. Over the past three months, Boeing's shares have increased 12.3%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.1% rise during the same period.

Longer term, BA stock is up 34.1% on a YTD basis, outpacing DOWI's 6.5% gain. Moreover, shares of the aerospace giant have soared 36.6% over the past 52 weeks, compared to DOWI’s nearly 9% increase over the same time frame.

BA stock has been in a bullish trend, trading above its 50-day and 200-day moving averages since late April.

Despite Boeing’s narrower-than-expected Q2 2025 adjusted loss of $1.24 per share and stronger-than-forecast revenue of $22.7 billion, shares fell 4.4% on Jul. 29. Investor sentiment soured as management delayed certification of the 737 MAX 7 and 10 models to 2026, far later than its prior year-end 2025 target, due to ongoing engine de-icing system issues. Additionally, the FAA’s cap on 737 MAX production after a January 2024 mid-air panel blowout raised concerns about Boeing’s ability to ramp up output.

However, BA stock has performed better than its rival, Lockheed Martin Corporation (LMT). LMT stock has dropped 7.1% on a YTD basis and 20.4% over the past 52 weeks.

Due to Boeing’s outperformance, analysts remain strongly optimistic about its prospects. BA stock has a consensus rating of “Strong Buy” from 27 analysts in coverage, and the mean price target of $255.88 is a premium of 7.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.