ServiceNow Stock: Is Wall Street Bullish or Bearish?

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Santa Clara, California-based ServiceNow, Inc. (NOW) provides cloud computing services that automate digital workflows to accelerate enterprise IT operations. With a market cap of $215.3 billion, ServiceNow has helped 85% of the Fortune 500 companies to modernize their technology with its digital-first business model, which enables them to innovate at scale and speed.

The cloud computing giant has significantly outpaced the broader market over the past year, but underperformed in 2025. NOW stock has soared 37.2% over the past 52 weeks and dropped 1.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 12.5% gains over the past year and 1.3% returns in 2025.

Looking closer, ServiceNow has also underperformed the industry-focused Fidelity Cloud Computing ETF’s (FCLD) 11.3% surge over the past year, but marginally underperformed FCLD’s 20 bps dip in 2025.

ServiceNow’s stock prices soared 15.5% in the trading session after the release of its impressive Q1 results on Apr. 23. The company’s offerings have continued to observe robust demand, pushing its financials beyond expectations. The company’s revenues for the quarter surged 18.6% year-over-year to $3.1 billion, exceeding the Street’s projections. Furthermore, driven by a slight improvement in margins, ServiceNow’s non-GAAP adjusted net income increased by an impressive 19.7% year-over-year to $846 million, surpassing analysts’ expectations.

On an even more positive note, ServiceNow crossed 500 customers with more than $5 million in annual contract value (ACV). Meanwhile, its remaining performance obligation at the end of Q1 stood at $22.1 billion, representing a solid 25% increase year-over-year.

For fiscal 2025, ending in December, analysts expect ServiceNow to deliver a 26.8% year-over-year surge in EPS to $9.13. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

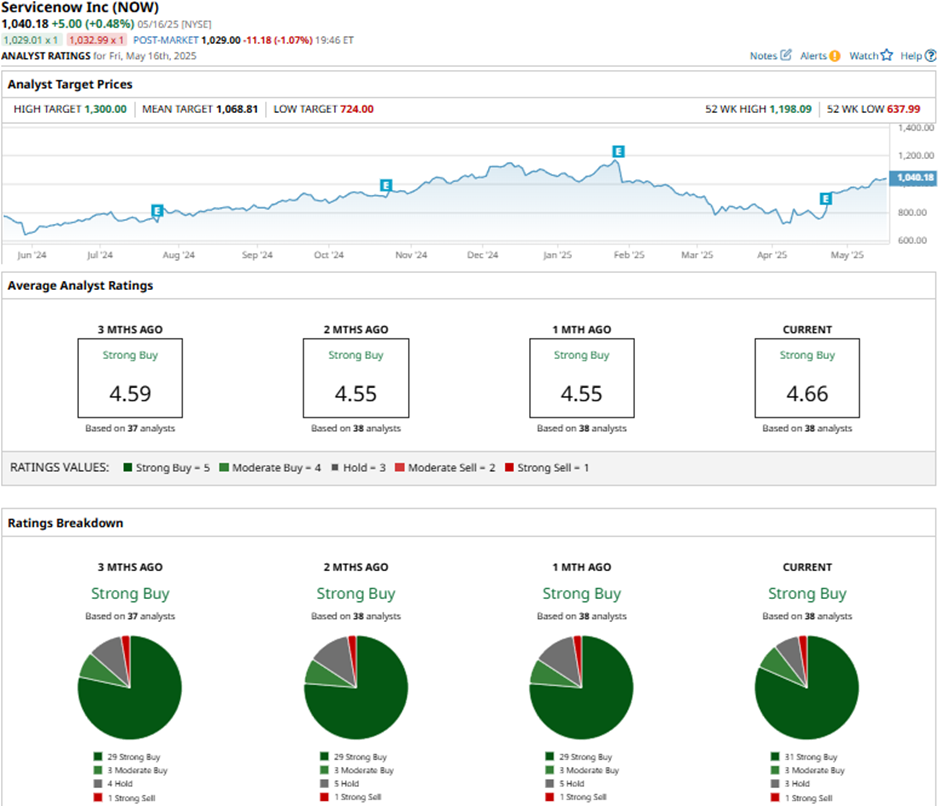

The stock holds a consensus “Strong Buy” rating overall. Of the 38 analysts covering the NOW stock, opinions include 31 “Strong Buys,” three “Moderate Buys,” three “Holds,” and one “Strong Sell.”

This configuration is considerably more bullish than a month ago, when the stock had 29 “Strong Buy” recommendations.

On May 14, BMO Capital analyst Keith Bachman maintained an “Outperform” rating on NOW and raised the price target from $1025 to $1150.

As of writing, ServiceNow’s mean price target of $1,068.81 represents a modest 2.8% premium to current price levels, while its street-high target of $1300 suggests a notable 25% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.